You can use the search field in the top right corner. Understand the pros and cons for each card and discover the features and benefits that could save you thousands of ringgit every year.

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

Assume that the steel utensil attracts a GST of 18.

. The Inland Revenue Board of Malaysia LHDN has announced a change in its contact number for its Hasil Care Line HCL effective 16 May 2019. But there were signs of recovery in 2021 as the economy grew by 31 per cent. In 2020 Malaysias economy contracted by 56 per cent due to the pandemic.

The GST Council announced the anti-profiteering rules on 18th June 2016. The manufacturer had paid INR 118 towards GST during the purchase of his input raw materials. Hence out of.

Malaysia has a strong educated workforce and English is widely used as a business language. WHY GST IS BEING CONSIDERED AGAIN. In the Accounting menu select Reports.

The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. Credit Card Reviews Reviews for the top credit cards in Malaysia. For example Singapore saw a hike in inflation when it introduced GST in 1994.

Banking Terms Definitions. Anti-profiteering rules are needed as lessons learnt from other countries show that there has been inflation and prices have increased after GST implementation. It makes it more important for Indian.

Hence the manufacturer is collecting INR 144 as GST on sale from the distributor. Find and open the GST Return. Use the Zero Rated tax rate and are dated before the current GST period.

Malaysia beat out countries like Australia and the United Kingdom to claim this spot. Malaysia has a well-developed infrastructure. So the manufacturer will invoice the pressure cooker for INR 944.

Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. Now the tax on it will be INR 144. View and file late GST claims.

If you want to include these transactions in your GST return youll need to add an adjustment. The Federation of Malaysian Manufacturers FMM welcomes the governments call to reintroduce the goods and services tax GST at a rate that will not burden the rakyat but still help widen the. The GST should minimise delay in refunds especially for exporters and businesses with zero-rated supplies as the long refund period between six to eight months has rendered the GST.

The new GST should also reduce the corporate tax rate to 20 keep all essential goods and services to a rate of zero and maintain the GST registration threshold at RM500000.

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Simulations Impact On Each Household Of Gst And Sst Payment Source Download Scientific Diagram

Non Resident Businesses Get Ready For Gst Hst Changes Kpmg Canada

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

26 June 2018 Heineken Words Word Search Puzzle

A Guide To Gst In Malaysia How Does It Affect Me

Gst Better Than Sst Say Experts News Summed Up

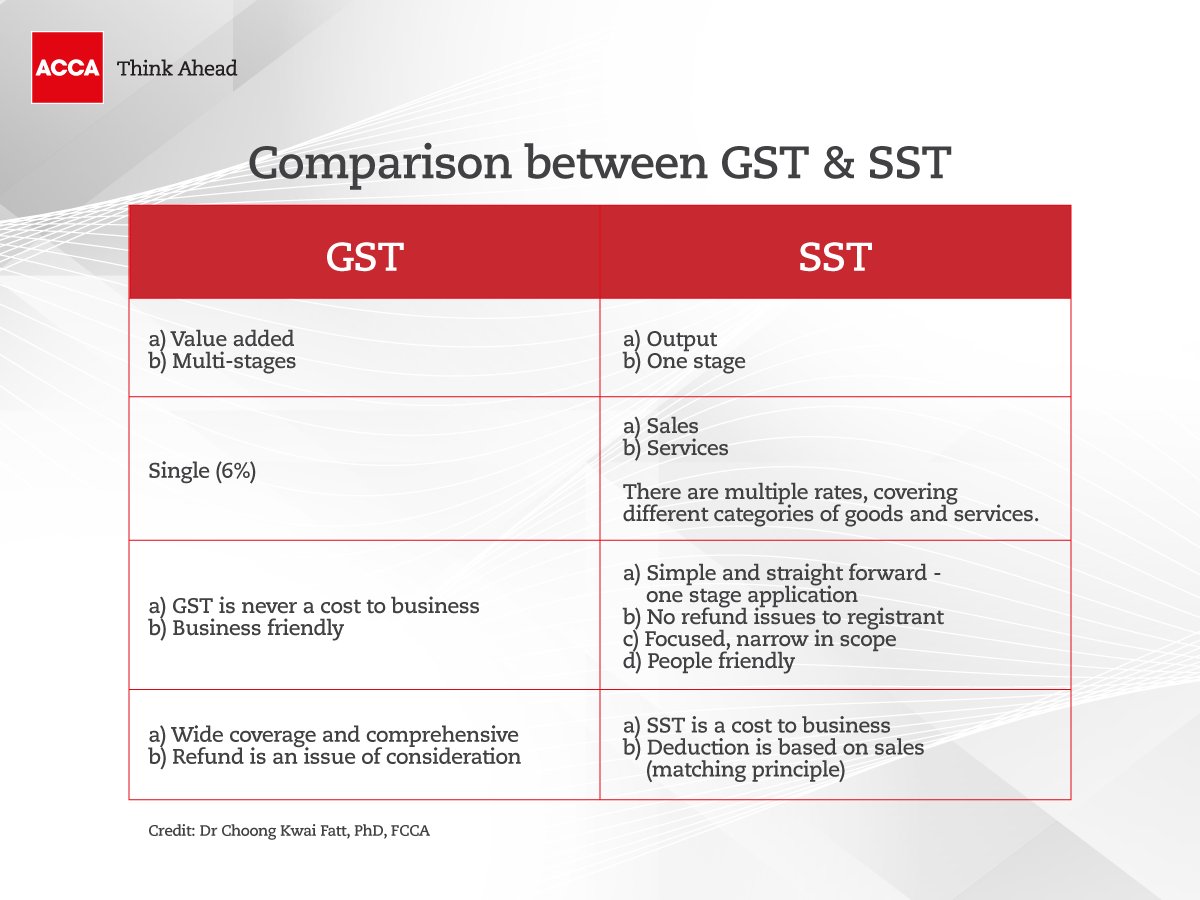

How Is Malaysia Sst Different From Gst

تويتر Accamalaysia على تويتر As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize

Goods And Services Tax Gst Is A Broad Based Consumption Tax Levied On The Import Of Goods Collected By Singapore Customs As Well As Nearly All Supplies Of Goods And Services In Singapore

Malaysia Sst Sales And Service Tax A Complete Guide

A Guide To Gst In Malaysia How Does It Affect Me

The Latest Enhancements To The Canadian Gst Hst Return Xero Blog

Difference Between Gst And Sst

A Guide To Gst In Malaysia How Does It Affect Me